Currency Ecosystems

What is a “Yin Currency”, and why is that important? How did such currencies affect the cultures in which they were used? why is that important to us today? Because it can give our culture the resilience, prosperity, harmony and sense of community and love that we are all looking for.

To reset the animation, click left arrow, then click the picture.

A currency by itself is like a single tree on a plain. The first thing to be struck by lightning, or blown over by a wind storm.

Our current money system is like a plantation of pine trees–all the same type, all subject to the same strengths and weaknesses.

A sustainable economy contains several different types of money. Yin and Yang, Crypto and physical and national and complementary and local, for starters. Diversity brings strength.

The GGCurrency System is just the type of Currency Ecosystem that will give strength, stability, prosperity and sustainability to our world.

Watch this slide show, read the text, and then come back and watch it again. See if you “get it” the second time.

Research cited by Lietaer shows that the present money system is inherently structurally unstable.

In spite of more and more regulations and restrictions on our money system, the Magicians at the Central Banks are unable to overcome its inherent instability. Lietaer likens it to a car with loose steering mechanisms and bad brakes: No matter how carefully you drive this car in the mountains, you are eventually going to have an accident!

|

Just as a loose steering system will cause a car to swerve uncontrollably from one side to the other, there are cyclical instabilities in our money system. These are generally called “business cycles”, and appear as periodic increases and decreases in the strength of market and economies. In stock markets, these cycles are called “bull markets and bear markets”. In the overall economy, large variations are called “depressions” or “Recessions” or “Crashes”, and “Recoveries”.

Efficiency vs Resilience

In Western culture, the focus is to make everything efficient—the most bang for the buck. Take the vitamin C from an orange, and discard everything else. Find the active ingredient in a plant, separate it out, and learn to synthesize it.

So what if that active substance works better synergistically with the medley of other factors found in the original plant—those are considered extraneous.

Plant only corn, and use pesticides to destroy all other plants, insects, soil organisms, higher life forms, and minerals in the soil.

Cram chickens and pigs and cattle into feed lots at the highest maximum density, and fill them full of antibiotics to delay the expected diseases that result from such unnatural environments.

Breed turkeys so they have hugely distorted chest muscles, so that they can hardly walk, but make lots of white meat for sandwiches.

This is the way to get the most efficiency from a system. Strip everything away except the one thing that you want to produce.

The problem with this focus on efficiency is that the system becomes very easily perturbed. What if someone drops a match on the floor of the pine plantation? Or what if a pine bark borer beetle shows up, then quickly spreads from tree to tree—there are no intervening trees to prevent flash fires or disease spread.

The same with high density feed lots for chickens and other animals—massive amounts of antibiotics are needed to keep disease under control, and those antibiotics are now making bacteria pathogenic to humans no longer susceptible to antibiotics.

Natural Ecosystems Have Many Species

Now, compare the paucity of life in a pine plantation with this with a naturally occurring ecosystem—a system of life forms growing together in an unorganized but healthy system.

There is no longer a monoculture of just one species, but many systems inhabit different niches in the ecosystem. Small plants, ferns, trees, bushes, all at different levels of the forest. And there is life, and death, eating and being eaten, in sustainable and stable interactions. I have been in forests like this, in Congo and South America and Washington State. Imagine dropping a match here? There would be no devastating fire. A disease? Would be diluted and overcome by the inherent health of the ecosystem.

Pandas are going extinct because they only eat one kind of bamboo. They may

be efficient, and everyone may like them, but their species is not at all resilient.

Resilience: Stability. Reparability. Sustainability.

The rainforest is not the most efficient system. But it is a system which can recover easily from an insult, from a perturbation or injury. It is resilient, self-repairing and stable. It has existed and produced prodigious amounts of life this way, for millennia. For millions of years.

Bernard Lietaer worked in the Belgian Central Bank, and helped to design the European Central Bank. He has seen the attempts of the Magicians to create the perfect, most efficient system. And he learned that the more efficient a system is, the less sustainable it is:

Pioneering new research from the Club of Rome

In 1972, the first Report for the Club of Rome – The Limits to Growth – famously spelled out the unsustainable consequences of an economic system that demands infinite growth in a finite world.

Just as The Limits to Growth exposed the catastrophic flaws in our economic system, this new Report from the Club of Rome exposes the systemic flaws in our money system and the wrong thinking that underpins it. It describes the ongoing currency and banking crises we must expect if we continue with the current monopoly system – and the vicious impact of these crises on our communities, our society as a whole and our environment.

It finishes by setting out clear, practical proposals for creating a money ‘ecosystem’ with complementary currencies to support and stabilise the current money system.

Greece and the eurozone crisis: the authors show that one of these proposals (Civics) could be applied, on the ground, now, across Europe, to reduce unemployment, mitigate the adverse social effects of the currency crisis and create a sustainable and flexible money system for the future. This alone makes it essential reading for policy makers, business leaders and economists, anybody concerned about sustainability (environmental, social, climate change), those working in the fields of monetary systems and anyone with an informed interest in the future of the planet.

Interest and Demurrage

Interest

Interest is a common principle for anyone who has used a bank. It is a fee charged by the owner for the use of money. When we deposit money into a bank, we are the owner of that money. (Though governments have decided that they would rather that you are no longer the owner of the money, but are an “unsecured shareholder” of the assets of the bank). The bank uses the money which you have lent to it, and pays you a fee for that use. That fee is interest.

If you borrow money from the bank, now you have to pay the bank to use the bank’s money. Even though the bank created it from nothing by just making an entry in your bank account!

This chart from Germany shows that those who don’t have as much money always pay interest to those who do have more money. It shows ten different groups of households with 3.8 million people in each group, arranged by income. The gold bars are how much they pay out in interest and bank fees. The grey bars show how much interest they receive from their assets. The 90%ile group is about balanced in interest paid and received. But the bottom 80% pay out more interest than they receive, usually much more, and the top 10% receives much more interest than it pays out.

The bottom 80% always pay net interest to the top 10%.

That is the way interest works. It concentrates wealth into the hands of the wealthy. Always.

This appears to be the reason for which interest is illegal in the holy books of the Jewish, Christian, and Moslem faiths: interest is basically unfair. It takes money from those who do not have much, and gives it to those who already have it. As a result, interest is like a tax which migrates towards banks and rich people. It is one way that the Yang-type scarce or “hard money” of all nations constantly flows towards the pockets of those who have more of it. It ALWAYS has this tendency.

Another problem with interest is that when the banks create money, they never create the interest they charge for the money! So to pay interest, the borrowers have to pay out of their principle that was created for some other use. This reduces the money in the community and sends it to the rich. Interest sucks money from the community to pay banks and wealthy people.

Imagine borrowing for a mortgage for a $100,000 house. The bank creates $100,000 for you (by merely putting that number in your bank account), but they do not create the money for the interest! And over 20 years, you have to pay back $200,000. Where does the extra $100,000 come from? It doesn’t exist! It was never made! To pay that interest money to the bank, you have to extract it from the economy by working harder. So, the economy has to keep expanding in order to keep functioning. There is no such thing as economic sustainability in an interest economy. If the economy does not expand, then someone will go bankrupt, because there is not enough money in the system to pay the interest on all the loans in the system.

Another characteristic of interest is that it encourages people to hoard money. They have a special word for it, “savings”, but it means that you are not spending that money, you are not circulating it around your community, you are leaving it in the bank to accrue interest. I am sure you are now thinking, “Of course! That is the best way to be!” And that is true, from the point of view of an interest society. And these traits of interest encourage short-term thinking, as we shall see.

Demurrage

Ancient Egyptians used a different system. Suppose you had an Egyptian farmer who brought grain to the granary. When he gave wheat to the granary, he received an ostracon receipt for, say, 15 bags of wheat. But when he came back months later to claim his wheat, he only got 14 bags back. One bag was consumed by the rats and spoilage and paying the guards. There was therefore a loss of value associated with the ostracon system. This loss has been called “demurrage”, from the French word for “rust”. Demurrage is basically reverse interest: a fee paid by the owner or user of money to the party who created it.

This idea sounds bizarre to most people who are very comfortable with the idea of interest. But, as we shall see, demurrage can have broad reaching beneficial effects on societies who use it.

Demurrage can be understood by considering the childhood game of “Hot Potato”. A group of children form a circle, and pass around a potato fresh from the oven, or another object to simulate the piping potato. At a predetermined arbitrary time, a bell rings or time is announced. And the child with the “hot potato” loses and is eliminated from the circle.

With demurrage, the usage fee may be assessed on a periodic basis (“when the bell rings”). This fee is what causes the “hot potato” effect, because no one wants to have to pay the usage fee when that time period is up. This encourages circulation of the money, rather than savings.

A study of a currency in Austria during the Great Depression showed that demurrage caused the currency to circulate 14 times as much as the national money! This saved the local economy from the surrounding economic depression for the 13 months that the central bank allowed it to continue. Please read about the Woergl, if you have not yet done so.

In the High Middle Ages, the common money used by the people were thin wafers of silver called bracteaten. Because these coins were so thin, they were easily damaged. And, they could have pieces broken off to pay smaller amounts.

Every few years the coins were collected, and the nobles reminted them, but for every 4 bractea collected, the users might receive only 3 in return. This was a means for the duke or Prince to make money from the people for the use of his currency. It was in effect a fee for using the money he issued.

This was equivalent to a tax of 25% over those years, or about 0.35% per month. This fee did not adversely affect the economy. In fact as we shall see, the people using this money were more wealthy than any other culture for hundreds of years before or after that society.

Yang money mentality vs Yin money mentality

In a Yang money system, the people are taught to SAVE MONEY for a rainy day. This is scarcity mentality, caused by the absence of the Great Mother archetype being active in our society. But, we assume it is the only way to think!

Yang money systems, or in other words, Interest systems, reward the individual, but not the community. Yang money systems, or in other words Interest systems, reward short term investments. That is how they teach us to think. For the benefit of the world, a new way of thinking might be helpful.

Demurrage causes a gradual decrease in the value of money. If the value of money is tending to decrease due to a fee on its use, then since it takes more money to buy things, the value of material goods will tend to increase. Thus, demurrage decreases the value of money, but increases the value of material wealth.

We have seen that because interest is charged, but not created, interest pulls value out of the economy of a society and sends it to the rich. But due to long-term thinking and the increased circulation of “hot potato” demurrage money, in a society using Yin-type money with demurrage, every transaction benefits the community, as well as the individual. Yin money also reinforces relationships, so it strengthens the community. Yin-type money with demurrage reinforces investment into long-term investments, investments into production capabilities and systems, instead of merely hording wealth.

In a yin money economy, it does not make sense to save in the form of currency. Instead, savings occurs in the form of tangible, productive goods, which last a long time.

For example, in the Royal Monastery of St. Denis, for the years 1229-1280, every year a significant part of the mills, ovens, wine-presses and other heavy equipment are improved upon or even completely rebuilt. At least 10% of gross revenue (not profits) was reinvested into equipment maintenance.

Sustainability: The Money Connection

As long as all major corporate decisions are made with a short-term horizon , long term sustainability is going to be an illusion

“Short-termism” is programmed by the interest feature of our conventional money

What do we invest in?

Suppose that we can invest in fast growing pine trees, or slow growing oaks. If we invest today in planting pine trees, in ten years we may be able to harvest $100 worth of pines. Or, in 100 years, we could have an oak tree worth $1000. Should we invest short term for the $100 pine trees? Or long term for the $1000 oak tree?

Notice that the value of $100 in 10 years is equivalent to $1000 in 100 years. In our society, there is not much thought about this kind of decision, because our money system teaches us to go for the short term goal.

As we have seen, interest extracts payment from the economy, taking away from the wealth of the community. Interest charged on our money means that the community ends up with less value.

If we assume a moderate interest rate of 5% per year, then paying for interest shrinks the value of our small trees down to $61.39 in 10 years. The balance was sucked out of the economy to pay the banks and the rich. And over 100 years, interest charges eats up all but $7.60 from our valuable big tree!! Thus, it certainly makes sense to use a short-term investment plan in an interest-charging society.

But Demurrage is reverse interest, a charge on storing or using money. Demurrage decreases the value of money, but it increases the value of material property, durable goods and productive systems.

Demurrage reduces discount rates, and thus increases the present value of a long-term investment. A system with demurrage at 5% per year devalues the currency but concentrates value in durable goods, and productive machinery and systems.

A system with demurrage at 5% per year devalues the currency but concentrates value in goods such as ancient trees and buildings.

So, the yin society would tend to invest in long term projects like oak trees, instead of short term projects like pine trees.

Cathedrals—Expression of Yin Society

The period of Dynastic Egypt and the High Middle Ages in Europe (about the 9th thru 12th centuries) shared some unusual characteristics. These were times of unusual prosperity, for the village as well as the castle. Food was abundant, and varied. Art, and especially love poetry, was prized, and the people had leisure time to devote to the arts. These times had better nutrition, less disease, and taller stature of the population than periods before and after. These were times of unusual power and freedom for women, who were allowed to work in almost any type of labor, to own property, to have legal rights, marriage rights, and education, and even to serve as political community leaders, artisans and troubadours. These are some of the effects of activating the Lover and Great Mother archetypes, or at least not repressing their natural expression. Please see more about these time periods in the Soul of Money.

An unusual shared characteristic of the Egyptian and Medieval timeswas a shared interest in a certain type of religious figure. In

Egypt, it is represented by the image of the goddess Isis with her infant son Horus. In Europe 1000 years later, it was the same image, but this time it was called “The Black Madonna”, and these same statues represented Mary and her son Jesus. These statues were found all over Europe at this time period, and their skin was painted black.

The chair that the Goddess sits upon is called in Greek “Kathedra”, and the buildings built to house these seats are called Cathedrals. But even though a great building was built to house one of these images, she was always kept in the crypt, below ground.

This devotion to the Divine Feminine was a reflection of the activation of the feminine archetypes, especially that of the Great Mother. The Cult of Mary reached its peak in the Central Middle Ages (9th – 12th Century).

In France alone, in just one century (from 1170 to 1270), over 100 churches and 80 cathedrals were built for Her!

In contrast, not a single one was dedicated to Christ–astounding in a religion that is supposed to be all about Him!

Chartres Cathedral

Bernard Lietaer asks just what it was which made the builders of the Chartre Cathedral spend all those hours carving details on stones which would never even be visible by the visitors.

Chartres Interior — Hidden Stones

He then points out that

the wealth which that town spent in building their cathedral is now still the main source of wealth sustaining the community 1000 years later!

This is a perfect example of the long-term vision which is activated by a society with an active Divine Feminine archetype.

Currency Ecosystem Revisited

A natural, healthy forest does not develop only oak trees, or only pine trees. Nor does it only develop ferns, or orchids. Each of these species has its ecological niche, and each helps to make the niches for the others. Orchids, for example, often depend on trees for their habitat. They are beautiful, and the most valuable species in some forests. But you will never find a natural habitat consisting only of orchids.

In the Currency Ecosystem, there may be one or more dominant types of currency. We might assume that these are fiat currencies, or in a more sustainable ecosystem, commodity-backed Yang-type currencies like a gold-backed dollar or RenMinBi. There will be strange cryptocurrencies stringing like vines from one side of the forest to the other. And then there will be, scattered among the dominant species, small and lovely and delightful little currencies, of types which bless communities, and nurture the elderly, and provide funds for local schools.

And between the forest floor and the forest giants, we see GGCurrency.

Trade Reference Currencies

As we saw in Part II, a little known fact about the Swiss economy is that Switzerland actually has TWO currencies. One is the famously stable Swiss Franc (CHF). The other is a complementary currency which has been around for 80 years, has the same value as the Franc, and is responsible for the remarkable stability of the Swiss economy during this time.

This link explains more about the Wir and how it works: The WIR Bank—Causing Swiss Economic Stability for 80 years

The Terra Trade Reference Currency

The Swiss WIR provides a countercyclical influence to stabilize the Swiss economy. This characteristic is used by Bernard Lietaer in his design of an international Trade Reference Currency called the Terra, which he created to fill an international niche similar to the one that the Wir occupies in Switzerland. You can read more about the Terra at its website.

A Trade Reference Currency provides a standard value for international trade, much as the US Dollar has provided for the last 60 years, except that the Terra is backed by the value of a basket of assets, including oil, gold, wheat, and currencies. The Terra adds to that the counter-cyclical stabilizing effects like those provided by the WIR in Switzerland. I hope that you can begin to see the value of this currency species in the ecology of currencies that we are designing.

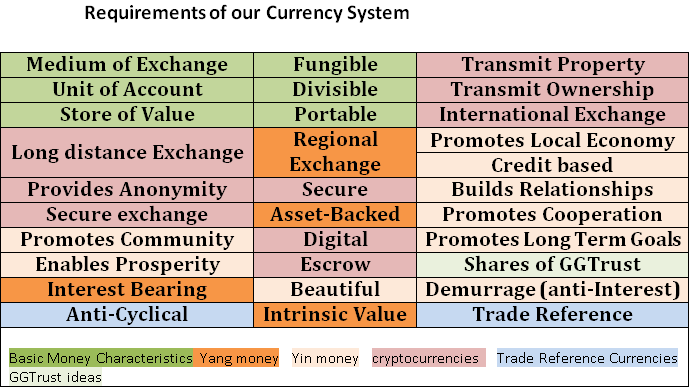

Requirements of GGCurrency System

When you add the favorable characteristics of Yang money to those of Yin money, and you throw in some nifty bits from cryptocurrencies and Trade Reference Currencies, as well as some of our own ideas, you can come up with a chart like this: